ev charger tax credit 2022

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. Assessing Proposed Changes June 15 2021 Biden Administration FY 2022 Budget GREEN Act Clean Energy for America Act five years through December 31 2026.

/cdn.vox-cdn.com/uploads/chorus_image/image/69405179/1232464562.0.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

In President Bidens State of the Union address the President voiced support for revisiting EV tax credits in 2022.

. SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or. Companies can receive up to 30000 in federal tax credit for commercial installations. 2020 2021 2022 Ford Escape PHEV.

So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this. This incentive covers 30 of the cost with a maximum credit of up to 1000. If so we have great news for you.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. The tax credit applies to each piece of EV charging equipment a business installs within New York and amounts to 5000 or 50 of the equipment cost whichever is less. By Andrew Smith February 11 2022.

On a time-sensitive note the Alternative Fuels and Electric Vehicle Recharging Property Credit will expire at the end of 2022. Another 4500 is available if an automaker makes the EV in the US with a union workforce. Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your.

Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed. The tax credit is retroactive and you can apply for installations made from as far back as 2017. Jan 13 2022.

Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market. Residential installation can receive a credit of up to 1000. AP PhotoEvan Vucci President Joe Biden last year scored record funding for electric vehicle charging infrastructure but his proposal to lower the sticker price for zero-emission cars and trucks all but died on the vine threatening.

A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a feature that flew under the radar for many. Unlike some other tax credits this program covers both EV charger hardware AND installation costs. The federal tax credit was extended through December 31 2021.

Search what is available in your area by entering a zip code below. Washington state ev tax credit 2022. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

Wells fargo private bank mortgage rates. Co-authored by Stan Rose. Department of Energys Federal and.

The tax credit covers 30 of a companys costs. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. However Tesla does not employ unionized labor so Tesla would be.

This incentive covers 30 of the cost with a maximum credit of up to 1000. 5 Mayer Brown Electric Vehicle and Charging Station Tax Credits. Another 500 is added for a US-made.

Currently the federal government offers a tax credit for both EV charger hardware and for installation costs. Vladimir guerrero jr future contract. Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Federal and State Electric Car Tax Credits Incentives Rebates. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

In addition to broad-scale electric vehicle incentives states and utilities provide incentive programs rebates and tax credits specifically for purchasing and installing EV charging equipment across the country. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. 2022 EV Tax Credits in Virginia Electric vehicles are energy efficient and affordable but another thing that makes them alluring is the fact that they often come with tax credits in Virginia.

Top high school wrestlers 2022. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

Soon after West Virginia Senator Joe Manchin. For residential installations the IRS caps the tax credit at 1000. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to.

For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. Furthermore Future Energy expects federal tax incentives to be quite robust in 2022. The 1000 tax credit for charging property installed at a taxpayers residence would not increase but would also.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars placed in service before 2027. Information specific to your state can be found on the US.

Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure. Several months later it seems that revisions to the credit are returning to lawmaker agendas. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

After reading the following overview learn more by contacting Pohanka Automotive Group. President Joe Biden speaking at a November 2021 visit to a General Motors electric vehicle assembly plant. You might have heard that the federal tax credit for EV charging stations was reintroduced recently.

The tax credit now expires on December 31 2021.

How To Claim An Electric Vehicle Tax Credit Enel X

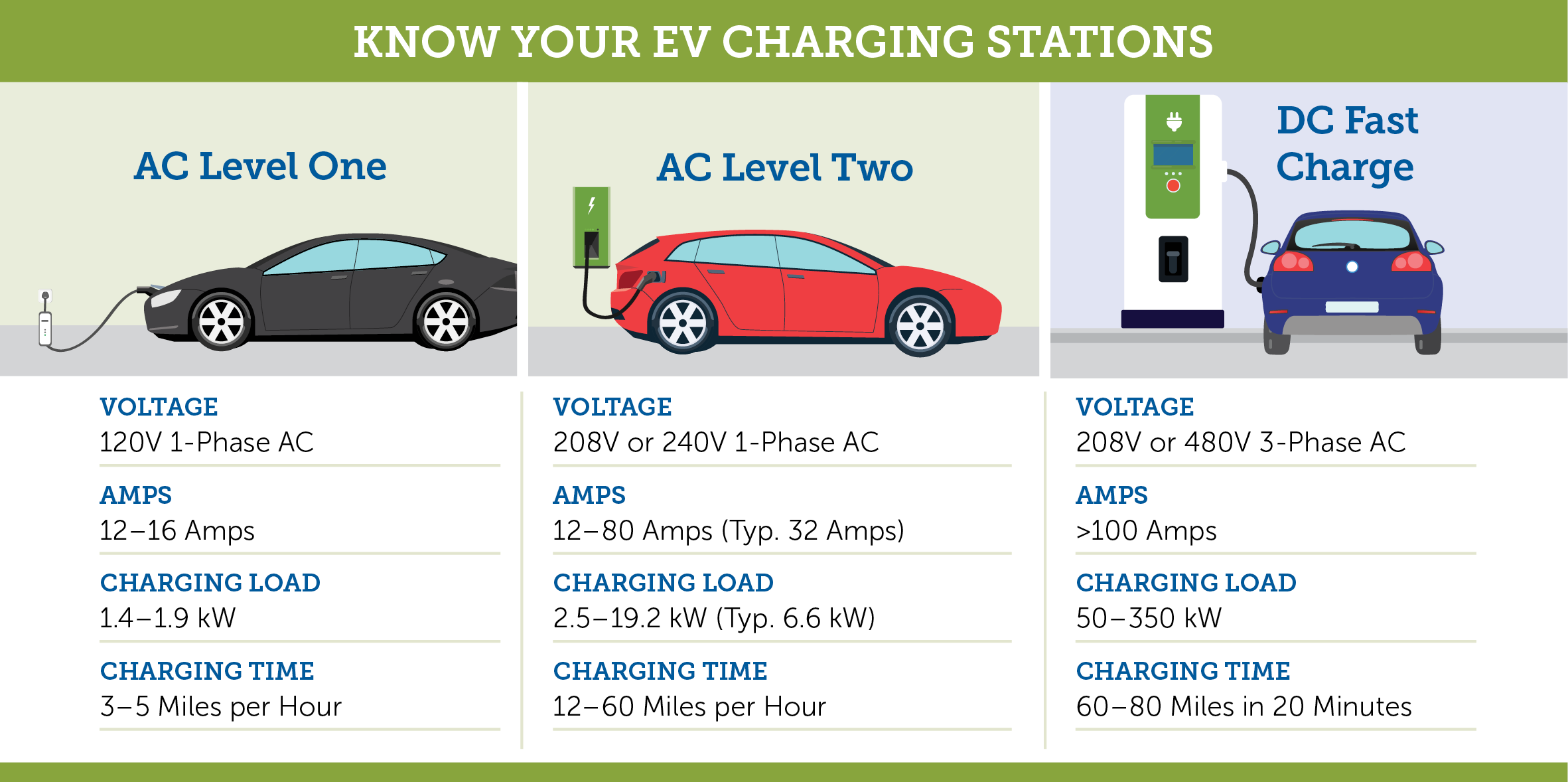

Ev Charging Stations 101 Wright Hennepin

Rebates And Tax Credits For Electric Vehicle Charging Stations

How The Electric Vehicle Business Tax Credit Works Evocharge

Commercial Ev Charging Incentives In 2022 Revision Energy

Tax Credit For Electric Vehicle Chargers Enel X

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

2022 Electric Vehicle Ev Charging Rebates Incentives

Rebates And Tax Credits For Electric Vehicle Charging Stations Electric Cars Electric Car Charging Electric Vehicle Charging

Ev Charging Station Volta By Raul Gonzalez Podesta Via Behance Car Charging Stations Ev Charging Stations Ev Charging

Tax Tips For Going Green In 2022 Electric Vehicle Charging Business Advisor Go Green

Find Charging Options For Your Electric Vehicle Carolina Country

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

What S In The White House Plan To Expand Electric Car Charging Network Npr

A Comprehensive Knowledge Base For Everything Around E Mobility Basics Beyond Electric Vehicles E Ev Charging Stations Electric Vehicle Charging Charging

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Guide To Home Ev Charging Incentives In The United States Evolve

Rebates And Tax Credits For Electric Vehicle Charging Stations